Technology and customer expectations have already prompted drastic changes in retail banking. Analysts at PwC expect the disruption to continue and identify the five most likely directions for how banking will unfold over the next three-plus years.

And the change is far from over.

“We can anticipate continued disruption of the banking industry in the coming years,” says Kurtis Babczenko, PwC Global Banking and Capital Markets Leader. “It is not an exaggeration to say that ten years from now, retail banking as we have known it may be irrelevant.”

Irrelevant is not only a strong word, but a chilling one, depending on where a financial institution stands on the transformation journey. PwC sought to explore how changes already underway in banking could impact the industry over the coming decade.

Big Forces at Work:

Embedded finance alone could render the familiar and traditional banking landscape unrecognizable.

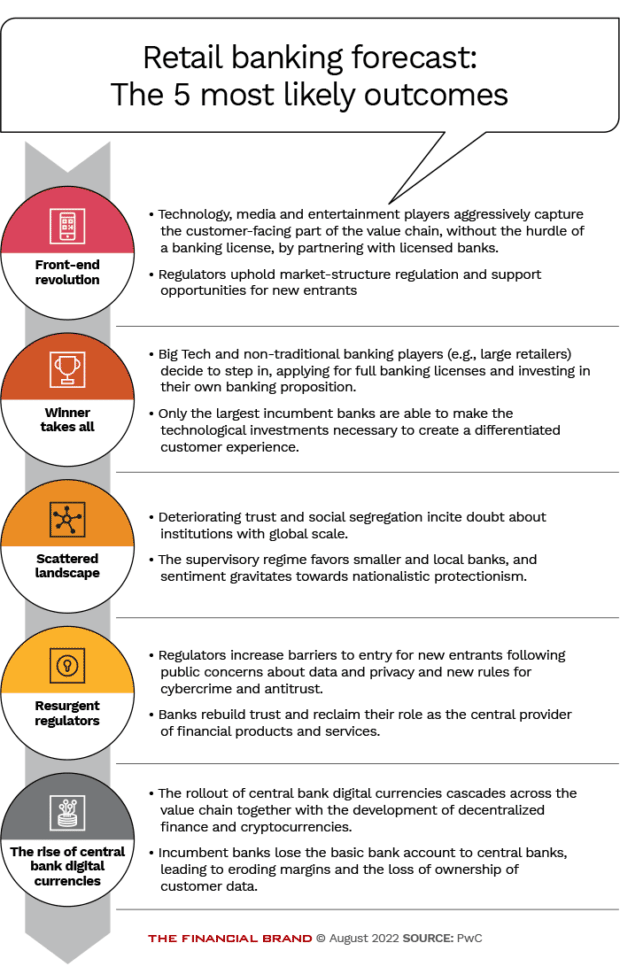

After cataloguing and handicapping the possibilities, they then created five scenarios for the future of retail banking and identified areas where banks and credit unions can take proactive steps to adapt to these changes.

PwC notes that it’s not a stretch to think the near future of banking could be a completely different reality than it is now. Banking may occur entirely in mobile apps and crypto wallets, while a few select institutions may dominate financial services.

Transactions may be conducted mainly through digital currencies, while subscriptions may replace fee-based banking revenues. Meanwhile, banks with extensive networks of branches may be dismissed as financial dinosaurs.

The consulting firm suggests banking leaders must understand several dominant trends to plot a course through a changing market landscape.

- Innovative technologies such as blockchain and artificial intelligence have changed consumer behaviors and enabled new products, while embedded finance has enabled non-banking companies to grow.

- Customers are evolving expectations, demanding speed and convenience at every interaction.

- While rising interest rates may relieve some pressure, persistently low rates have squeezed net interest income over the past decade and that situation could return.

- Consolidation will remain critical for banks to optimize technology, operations and their balance sheets.

- Regulations will only grow more complex as regulators strive to balance the pace of innovation and societal expectations with financial stability.

Five Scenarios for the Future of Retail Banking

While the above trends are already at play, they are in the earliest stages, and the ramifications have yet to unfold. PwC developed five scenarios for how events might play out in the next decade if these trends continue as expected. These scenarios aren’t meant to be predictions, nor are they mutually exclusive, says Babczenko.

“They are grounded in trends that have already begun playing out [and are intended] to help incumbent institutions consider the capabilities and resilience necessary to thrive in a far more dynamic environment,” he said.

1. The Front-End Evolution

In this scenario, embedded finance will flourish, enabling further disintermediation of the financial services value chains and client data. (Simply put, embedded finance enables financial products such as credit or payments to be incorporated into a broader nonbank product. A regulated financial institution provides the embedded product usually “in the background.”)

As a result, Big Tech firms and fintechs will capture most client relationships while a handful of banks will provide middle and back-office operations, risk management, and compliance activities.

While financial institutions may be inclined to dismiss this scenario, few would have considered a decade ago that consumers would be able to directly pay retailers through digital wallets on their smartphones.

“Looking ahead, the possibilities for how embedded finance and the use of crypto wallets can evolve to enhance the customer experience are endless — and the result is likely to be a financial services landscape that is nearly unrecognizable in the next five to ten years,” said PwC’s analysts.

2. Winner Takes All

In the winner-takes-all scenario, consolidation will push banks to join forces and take on the fintech and non-traditional financial services companies. As a result, a few incumbents and fintech companies will dominate the banking landscape, generating competitive advantages through scale.

Customers will gravitate toward the largest, most personalized and most convenient platforms. As only the largest banks can take the risk of making significant investments, scale will be more important than ever.

3. Scattered Landscape

This scenario sharply contrasts with the previous one and it’s unlikely both will prevail. Deteriorating societal trust and social segregation will lead consumers to question the value and integrity of global institutions. As a result, clients and assets will flow to more local banks with smaller balance sheets.

The banking value chain will then break into specialized components. Smaller, community-focused institutions will develop ecosystems that can offer banking products through a trusted local or regional brand that owns the entire customer relationship. Meanwhile, large incumbent banks will face the choice of refocusing on specific communities or provide narrower infrastructure and back-office services to banks via a B2B model.

4. Resurgent Regulators

Regulators will take an active approach to non-traditional entrants to ensure a robust financial system. Signs of this are already evident in 2022, although, as always, there is a political element to regulatory trends. Nevertheless, concerns about the duty of care, risk and customer protection will likely lead to new regulations.

Regulatory protectionism would eventually open the door for banks to rebuild trust and reclaim their role as the central provider of financial products and services. However, increased regulatory burdens could also make it harder for banks to innovate, leading to higher costs and more standardization of products and services. Shrinking margins could force firms to become cost-sensitive and consolidate to gain scale.

5. Rise of Central Bank Digital Currencies

Declining use of cash and the adoption of central bank digital currencies (CBDCs), a more structured and regulated form of cryptocurrency, would cascade along the value chain with the development of decentralized finance (DeFi).

Incumbent financial institutions would eventually lose the primary bank account to central banks. This would lead to a loss of customer data and an anchor of customer relationships that banks have long held, eroding margins, and a loss of net interest income. Banks would also have to make additional investments to transform technology and operations to handle digital currencies. All of this explains why industry groups are pushing back against CBDCs, yet the appeal and power of digital currencies is unlikely to fade away.

How Banks Can Reimagine their Business

Whichever of these scenarios comes to fruition, and it could be a mix, banks and credit unions must repurpose themselves to remain relevant, said PwC’s analysts. And while these scenarios are cautionary, they offer lessons from which financial institutions can consider trade-offs and action plans.

Crucial Trifecta:

Traditional financial institutions must focus on tech-powered transformation, increasing customer value and enhancing trust through ESG.

“Regardless of how the scenarios we identify play out, one thing is certain: the result will be a radically different competitive environment than today’s,” says Babczenko.

He recommends incumbent financial institutions redouble their focus on three key priorities.

- Banks and credit unions should focus on tech-powered transformation, building for innovation to succeed as new business models emerge.

- Traditional institutions must also increase focus on customer value, using analytics and data to create value in an “instant everything” world of embedded finance.

- As trust remains the most valuable currency for retail banks, they should have an integrated ESG (environmental, social, governance) strategy.

Although there is room for debate over the magnitude and speed of the scenarios that PwC outlined, Babczenko says the need for institutions to adapt to a different banking world is very real. The scenarios the firm outlined are meant to inspire and help banks and credit unions prepare for inevitable change.

You must be logged in to post a comment.