by Josh Howarth

From crypto to DeFi, the world of finance is changing faster than ever.

And financial services (like banks, insurance, and money management) are scrambling to keep up.

Many of these new trends come on the back of changing technology. While others are the result of a renewed focus on the customer.

Let’s look at a handful of current and developing finance trends that are set to explode over the coming months.

1. The Financial Services Industry Embraces Blockchain

For years, blockchain technology has been synonymous with cryptocurrency. However, experts believe that the technology will now become more integrated with existing financial systems.

For example, using blockchain would allow banks to conduct cheaper, more efficient transactions while maintaining tight security.

It can also be used to handle peer-to-peer lending, an industry that could see a growth of up to $150 billion by 2025.

More banks are transitioning to cloud-based banking in 2024, and blockchain will no doubt play a role in this.

HSBC and Wells Fargo already use blockchain technology to settle forex trades.

Paypal, Mastercard, and JP Morgan all allow users to make payments on their networks using blockchain currencies.

This involves cryptocurrency, of course, but it shows banks’ willingness to embrace blockchain.

It’s not just banks incorporating blockchain, either.

AXA, the French multinational insurance company, uses blockchain technology when insuring clients against flight delays.

An Ethereum blockchain then connects both the insurance contract and air traffic data.

As soon as a flight is over two hours late, the system takes notice and automatically triggers the insurance payout.

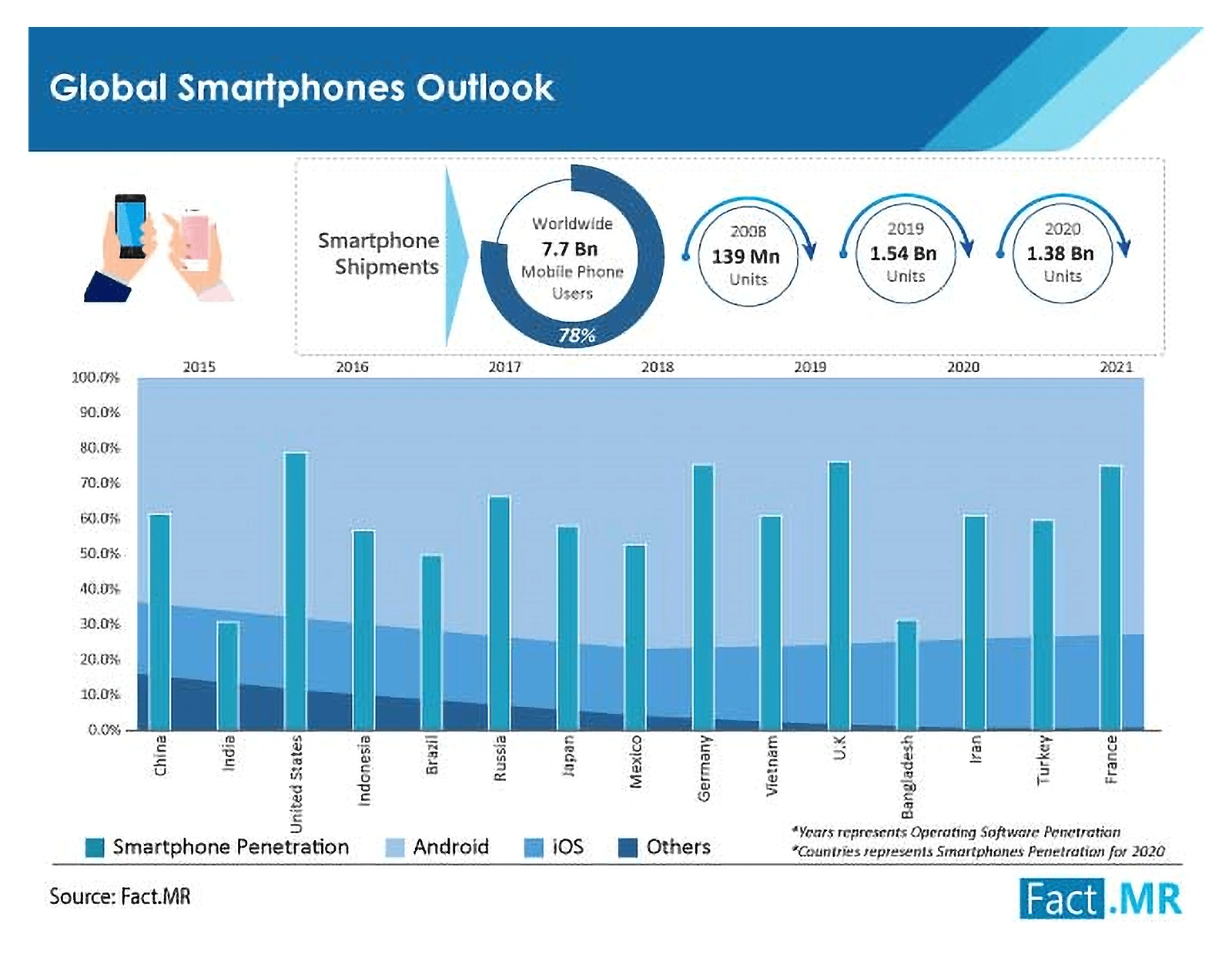

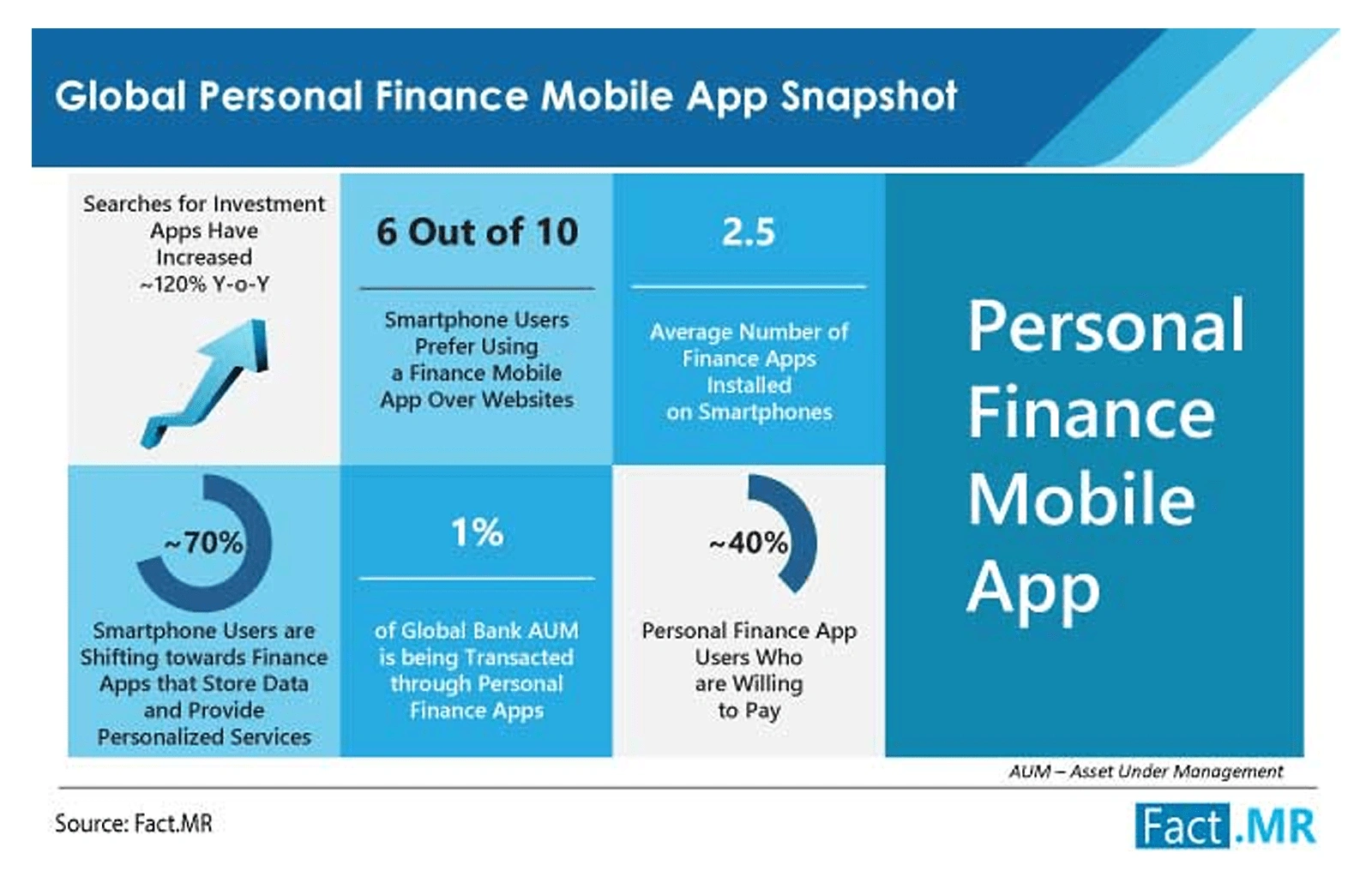

2. More People Download Personal Finance Apps

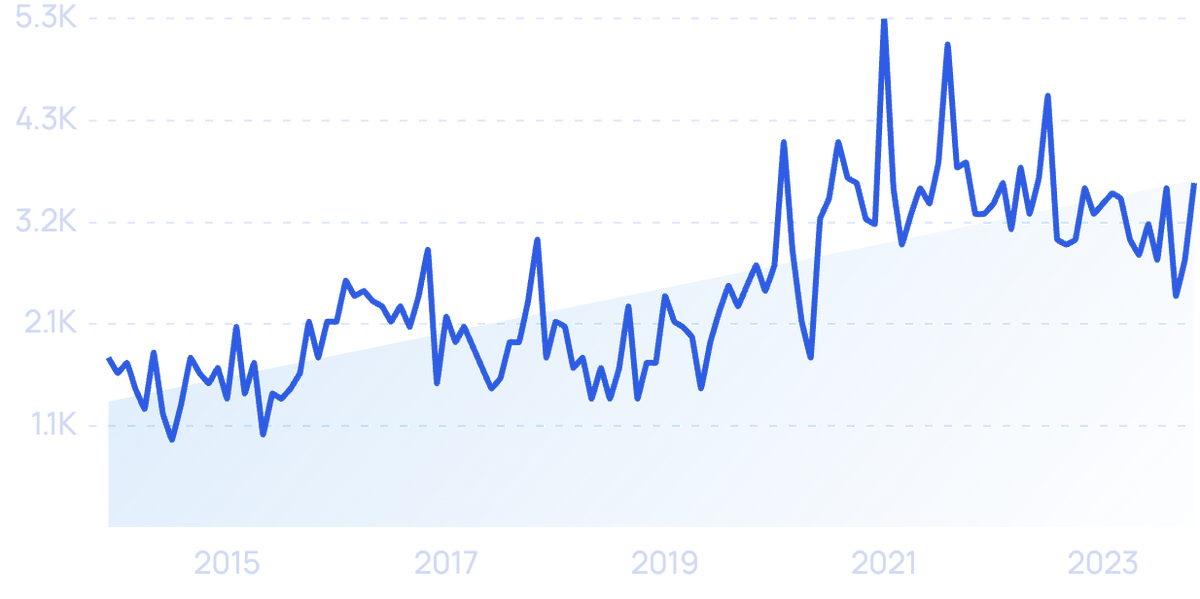

During the pandemic, downloads of personal finance apps grew roughly 90%.

Finance apps like Mint, Prism, and EveryDollar provided exactly what people were looking for and their popularity went through the roof.

These apps not only help people manage their money, but they offer ways to invest in stocks and crypto.

It’s not just the ability to manage your money remotely that’s attracting people, either. People specifically like having the power to run their financial world (literally) in the palm of their hand.

And as the US adopts open banking, which will make financial apps even safer, this number will likely increase. And skeptical users who harbored security concerns might be persuaded to take a second look.

Square’s Cash App remains the most popular personal finance app available, and among its list of benefits is a rewards system, which ties into what we discussed above about customer loyalty programs.

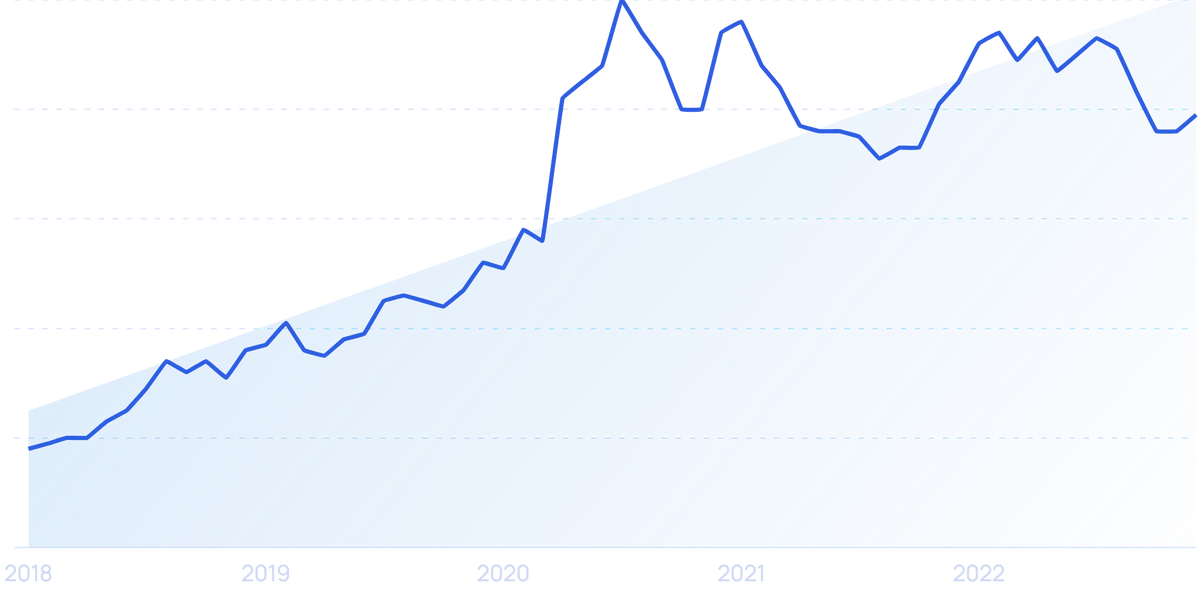

3. More People Get Their Money Professionally Managed

A new kind of wealth manager is quickly becoming the de facto money manager for many consumers: RIA.

A Registered Investment Adviser (RIA) is a firm that is regulated by the Securities and Exchange Commission and specializes in giving financial advice and managing investments.

Compared to typical broker-dealers, RIA’s have what is known as a fiduciary duty to their clients.

This means that they are required to put their client’s interests before their own when making financial decisions.

This kind of high-touch and client-focused model is gaining traction in the US.

At the end of 2020, RIA’s managed a collective $110 trillion supplied by over 60 million clients around the US This is compared to roughly $20 trillion at the beginning of this century.

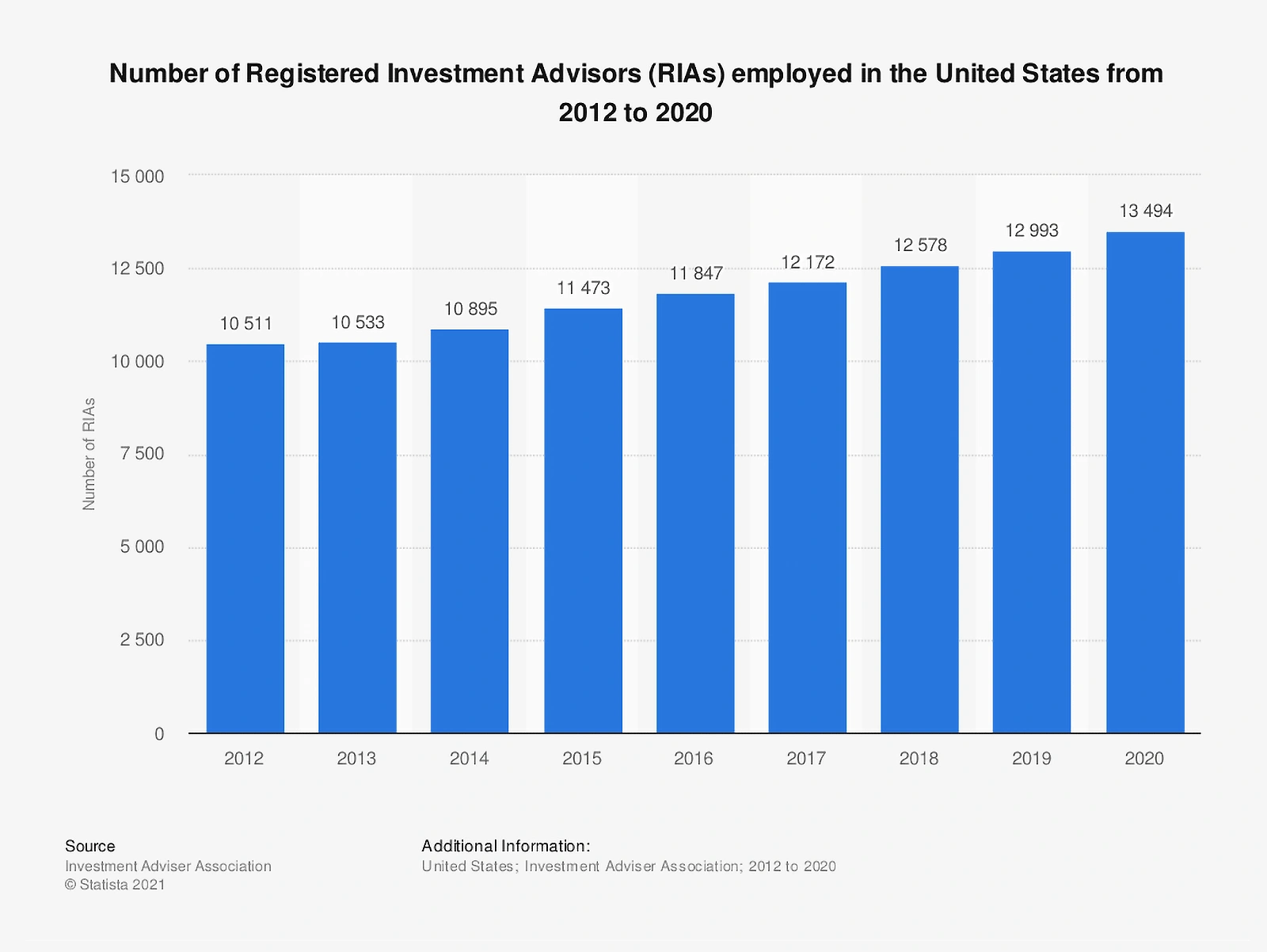

In addition, there are now just under 14,000 RIAs nationwide, employing close to a million people.

Even at this growth rate, 47% of RIAs still believe that the industry has a lot of room to grow.

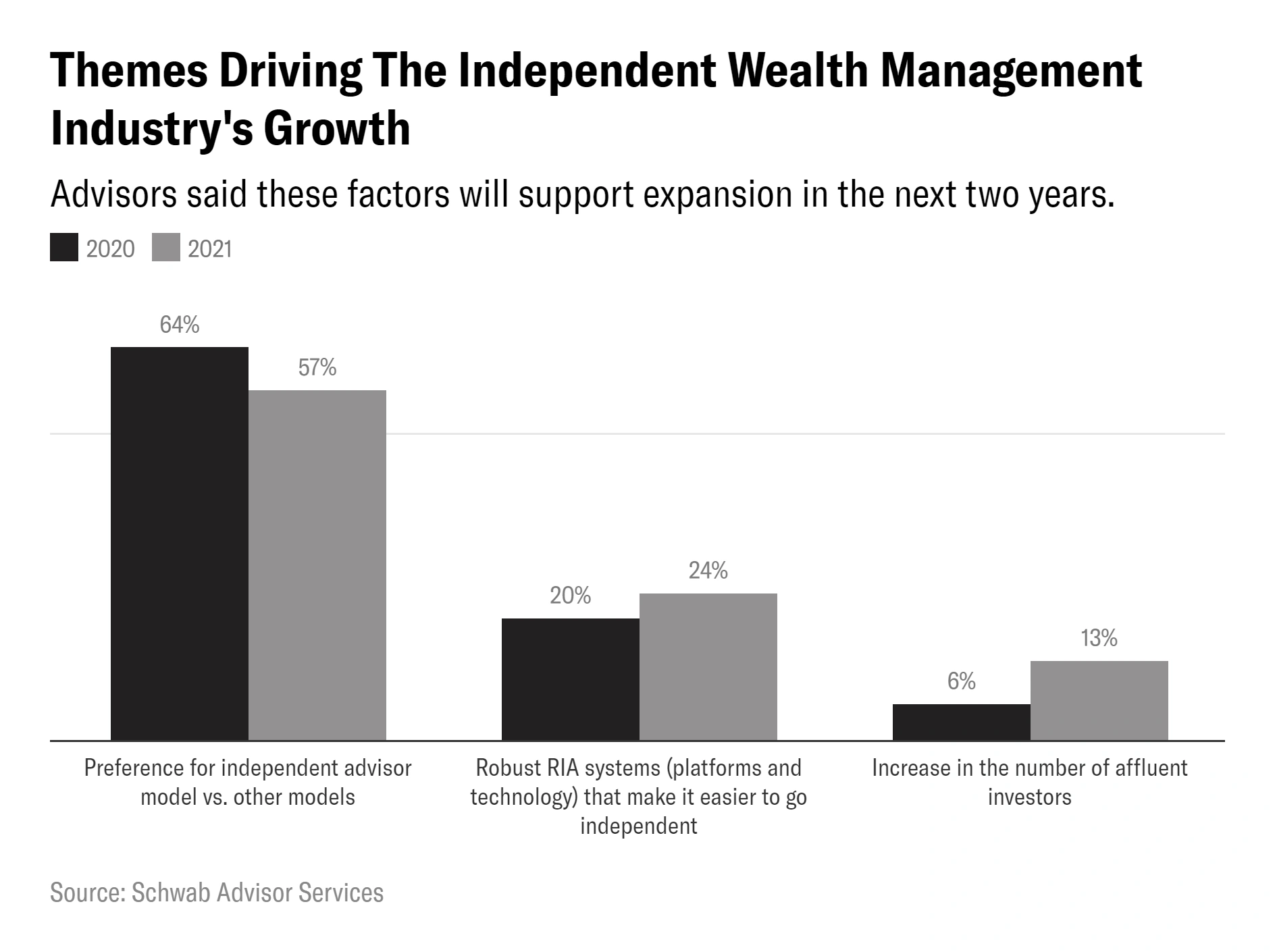

A study by Schwab found that over half of investors prefer to have a fiduciary (an RIA) manage their money compared to any other model.

Overall, it seems that the growth of the RIA industry is leading more Americans to consider letting a professional manage their money.

4. Loyalty Programs Drive Repeat Business

From half-full punch cards sitting in the back of your wallet to website-specific rewards programs, the idea of a loyalty program is nothing new.

However, we’re seeing an uptick in loyalty programs in the finance world.

Loyalty programs have long been a popular way to keep customers coming back, but they’re usually offered in retail and the food industry.

Now, loyalty programs are practically mandatory, even in the financial services industry. Many believe that they’re only going to get bigger, better, and more competitive.

In August of 2021, an American Banker/Monigle Agency survey of banking customers found that, regardless of financial institution or product, “rewards and loyalty remain paramount to the customer experience”.

Most customers, 80% of millennials and 68% of non-millennials would be willing to sign up for a premium loyalty program offered by their favorite brands.

Repeat customers spend at least 33% more than new customers.

And more than 80% of millennials and almost 75% of baby boomers like to get rewards simply for engaging with their favorite brands, whether or not they make a purchase.

A good example of this is CitiBank’s “thankyou” rewards program, which lets customers earn points by simply using their mobile apps or ATMs.

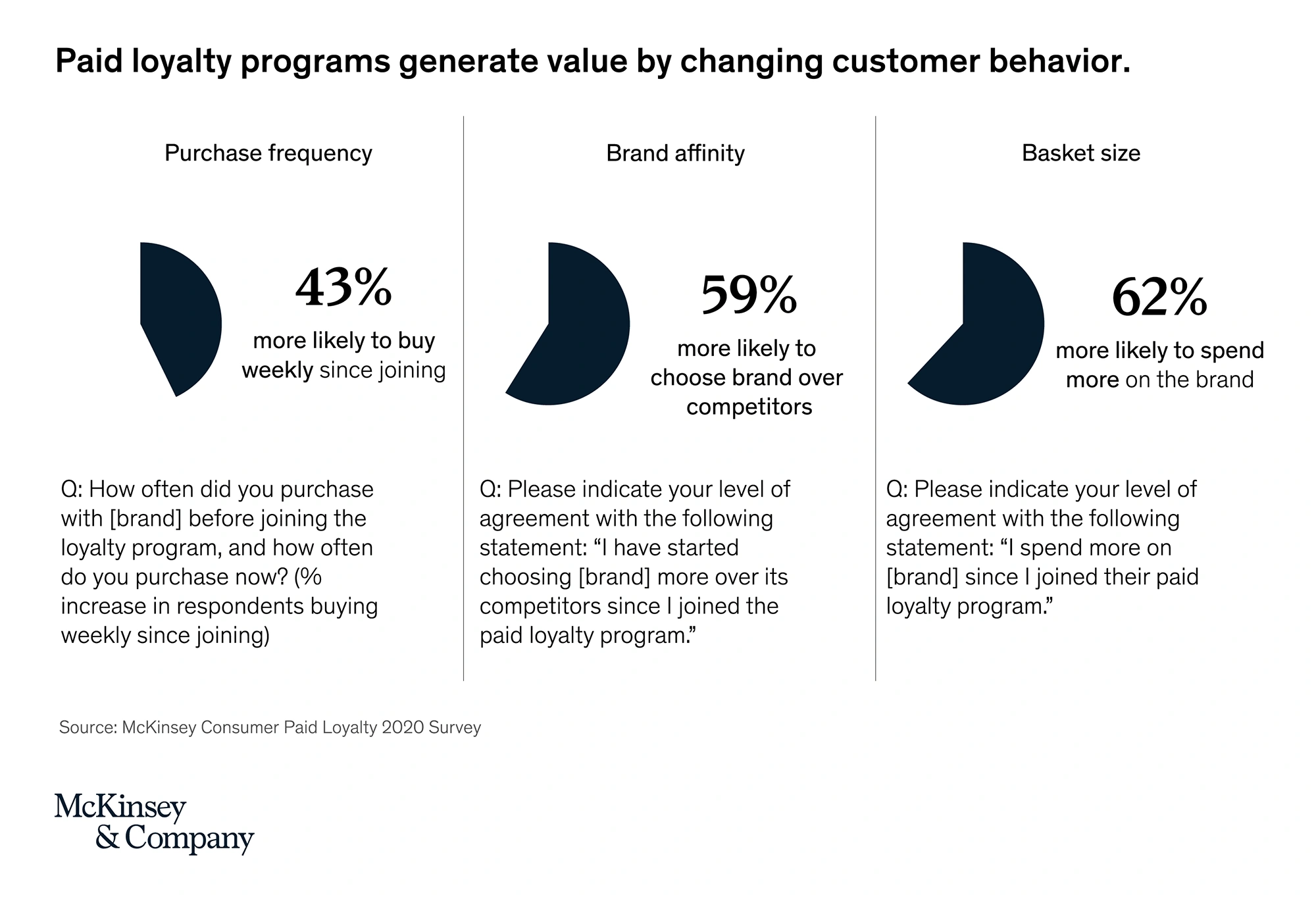

A survey conducted by McKinsey & Company showed that consumers who belong to paid loyalty programs are 62% more likely to spend more money on that brand.

Interestingly, when it comes to free loyalty programs, that number is only 30%.

Banks are losing the “tender wars” to companies like PayPal and programs like Buy Now, Pay Later. Offering a good loyalty program may be one of their few remaining options to bring consumers back.

5. Banks Further Embrace The Cloud

Banks were already gravitating towards the cloud pre-pandemic, but the pandemic really sped things up.

As people grow warier of physical contact, the demand for digital services rises, so banks need a way to scale up quickly.

The cloud provides just that.

Market research company IDC estimates that global spending on cloud services will surpass $1.3 trillion by 2025, just three years away.

Banks and credit unions will be a part of that, with heavy hitters like JPMorgan Chase and Arvest Bank already converting part of their core systems to a cloud-native platform.

Jim Marous of The Financial Brand believes that cloud banking is the future, citing the fact that IBM has developed cloud solutions specifically for the financial industry.

Microsoft introduced its own offering last year with Microsoft Cloud for Financial Services.

According to Genpact, banking industry CIOs claimed that updating their applications to function in the cloud helped their companies to adapt in 2021.

Another survey, this one conducted by Harris Poll and Google Cloud, showed that, of the 1,300 financial services leaders polled, 83% of them were using the cloud as part of their primary infrastructure.

MANTL is one of the companies that is focused on the cloud banking market.

The company basically helps traditional banks expand into the digital market.

MANTL does this by developing products that allow banks to automate back-office functions, set up an online presence, and onboard customers digitally.

Overall, the company boasts that its customers can expect to receive four times more account applications with a digital offering powered by MANTL.

Artificial intelligence plays a big role in the adoption of cloud services. Not only does AI provide chatbots, but it can also analyze transactions, monitor suspicious activity, and perform other tasks just as well if not better than human counterparts.

Investing in AI would generally cost more than banks would be willing to consider, but if AI was packaged with cloud services, that would become a very appealing offer.

6. Banks Move Past Overdraft Fees

Overdraft fees have long been a thorn in the side of bank customers everywhere. They’re known for not only being excessive but also having a tendency to snowball and reach absurd amounts.

According to the Consumer Finance Protection Bureau, overdraft and non-sufficient funds revenue totaled $15.47 billion in 2019.

Of course, that doesn’t mean that banks will just up and get rid of them (though Ally Financial did just that last year and Capital One followed suit in January), but multiple institutions are implementing new features designed to help customers avoid fees at all costs.

Bank of America added a feature called Balance Connect, which allows users to automatically transfer money to and from accounts to prevent possible overdraft fees.

There’s still a fee of $12 per transfer, but that’s less than the usual overdraft fee. Plus, there’s less chance of it compounding as dramatically.

PNC is offering a new feature called Low Cash Mode that will let customers change the order in which transactions are processed in order to avoid overdrafts.

JPMorgan Chase is giving customers more opportunities to restore overdraft balances before they get charged a fee. They’re also letting customers access direct deposited paychecks two days early.

There are two major factors in banks suddenly looking to eliminate or lessen overdraft fees:

One, everyone is doing it, and no bank wants to be the last one charging overdraft fees. In an age where consumers want loyalty programs, going the opposite direction is a good way to go out of business.

Two, with the release of the CFPB report mentioned above, the agency announced its intentions to begin zeroing in on banks that have, as Director Rohit Chopra puts it, “become hooked on overdraft fees to feed their profit model”.

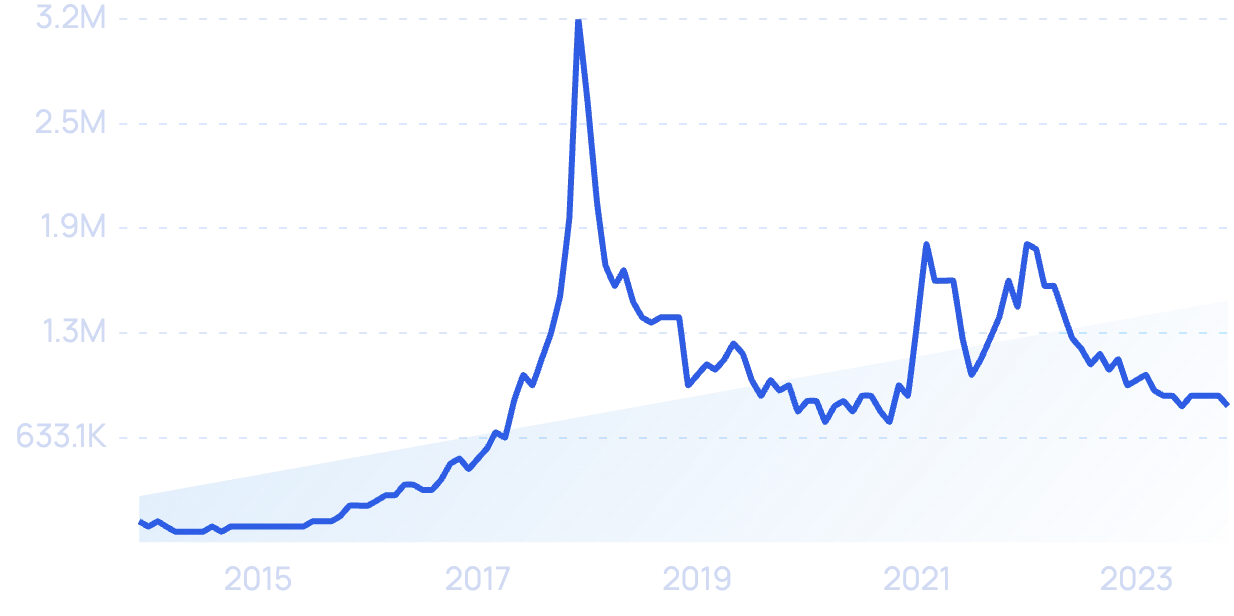

7. More Non-Tech People Get Into Crypto

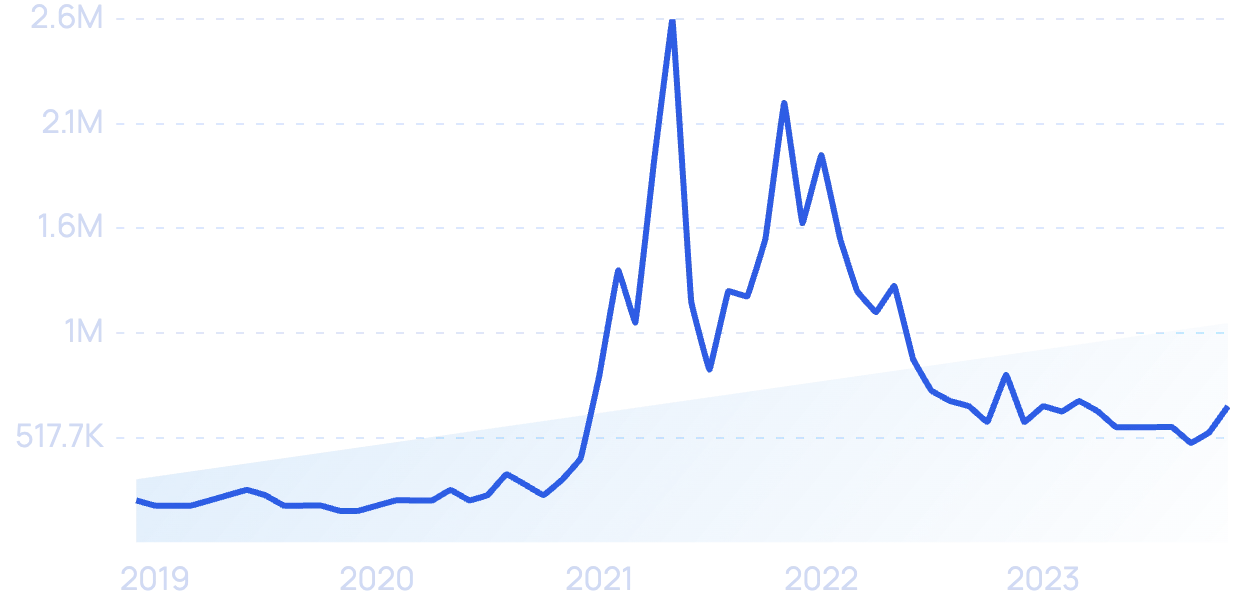

As of November of 2021, total cryptocurrency market capitalization had topped out at $2.79 trillion.

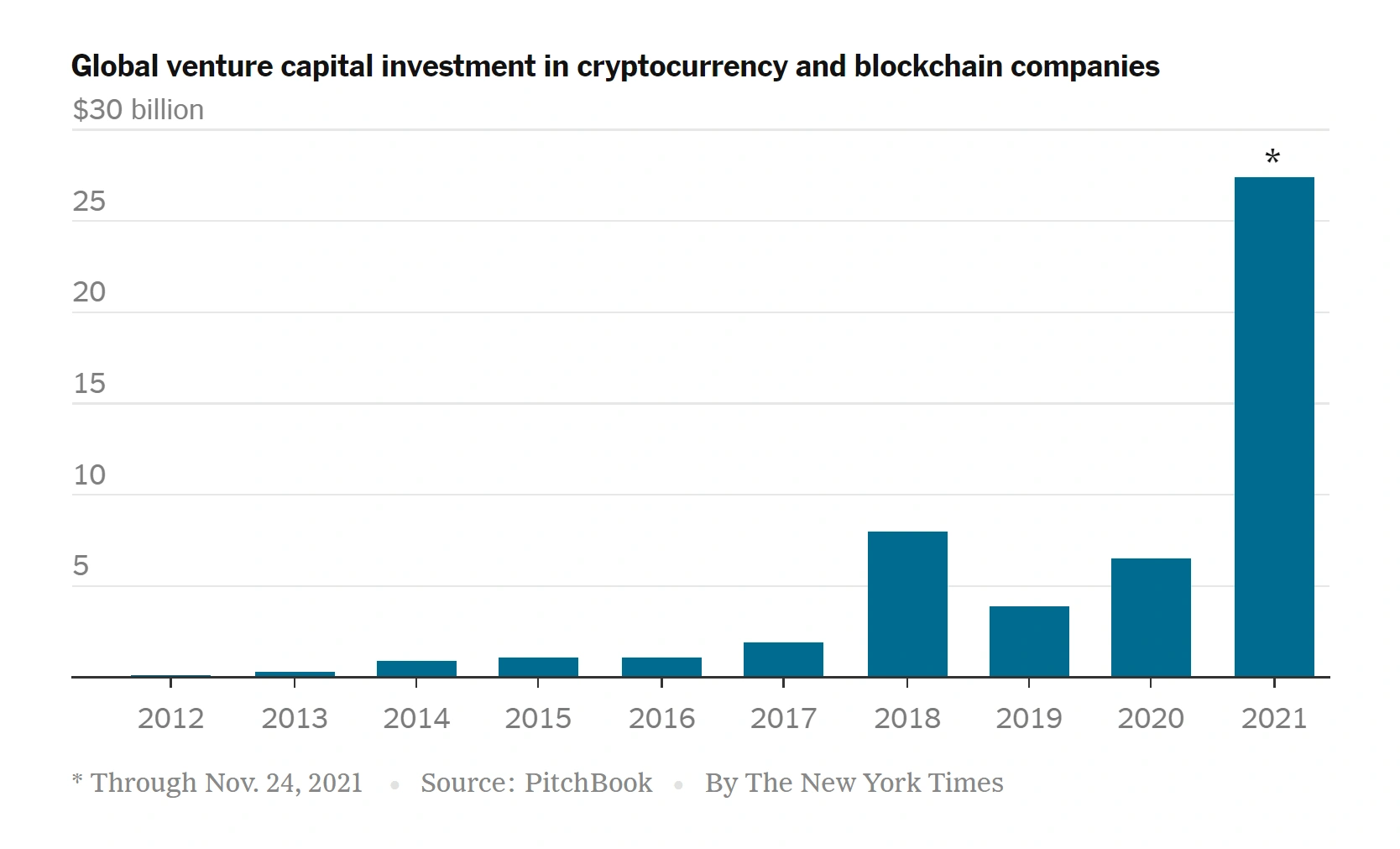

Venture capitalist firms purchased over $27 billion in crypto in 2021, almost five times more than they spent in 2020.

In a move that should signify that crypto is, in fact, getting even bigger, US President Joe Biden recently signed a bill that requires all crypto exchanges to be reported to the IRS.

This sort of oversight wouldn’t be necessary if cryptocurrencies weren’t poised to become even more popular.

The very first Bitcoin ETF – exchange-traded fund – hit the New York Stock Exchange in October, allowing traders to invest in a more conventional way.

Instead of buying crypto, they’re instead able to invest in companies that have a financial stake in crypto. So, they’re still susceptible to its volatile nature, they’re just inserting a middleman.

Interest in cryptocurrency isn’t limited to the private sector, either.

As of September 2021, the El Salvador government now demands that all of its local merchants accept Bitcoin as legal tender.

This prompted other Central American countries, like Honduras and Guatemala, to begin looking into central bank digital currencies.

This also had an impact on the US, where 27% of Americans polled answered in favor of adopting Bitcoin.

While some countries, namely China, are strongly opposed to cryptocurrency, the vast majority are considering how they can bring crypto into the fold.

Conclusion

Things are definitely moving away from traditional financial practices.

Unsurprisingly, everything is going digital.

Financial services are looking at the cloud and the blockchain, customers are looking at mobile banking, and everyone is looking at crypto. It’s an exciting time to be in the financial services industry.

You must be logged in to post a comment.