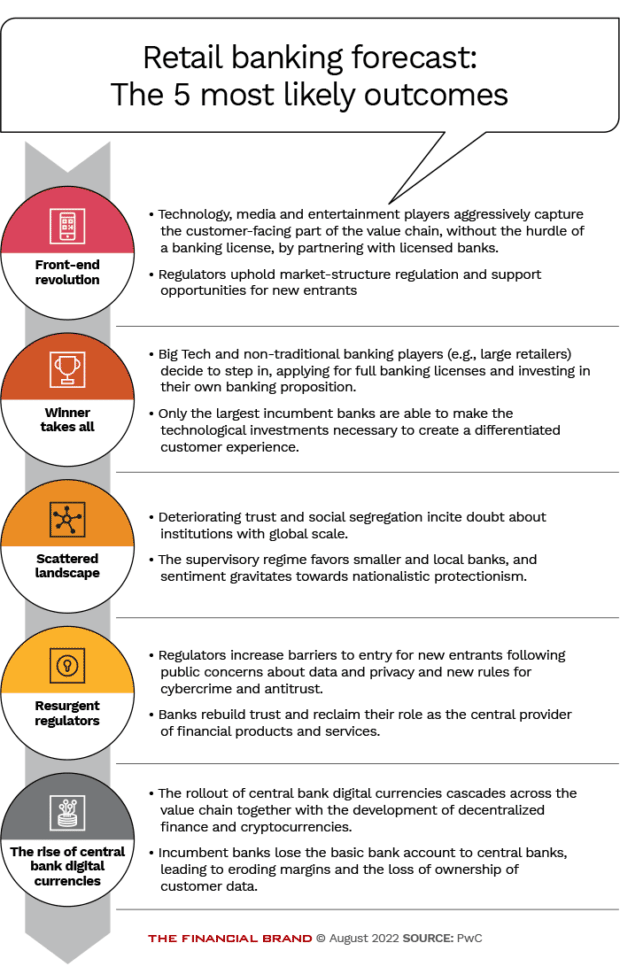

Tree Map reveals the Impact of the Top 10 Renewable Energy Trends

The Tree Map below illustrates the top 10 renewable energy trends that will impact companies in 2024. Advanced photovoltaics (PV) innovations are honing in on high-efficiency technologies. Moreover, big data and AI are enhancing renewable energy, facilitating applications like predictive maintenance and smart management. At the same time, distributed energy storage systems (DESS) add flexibility and stability to renewable energy generation.

Grid integration technologies are reducing transmission losses and stabilizing the grid effectively. These technologies optimize the use of off-grid sources such as biofuels, wind, and hydropower, even when situated far from demand centers. Further, green hydrogen plays a dual role, storing energy from renewables and aiding electrification. Meanwhile, bioenergy holds its ground as a favored choice, thanks to its decentralized nature.

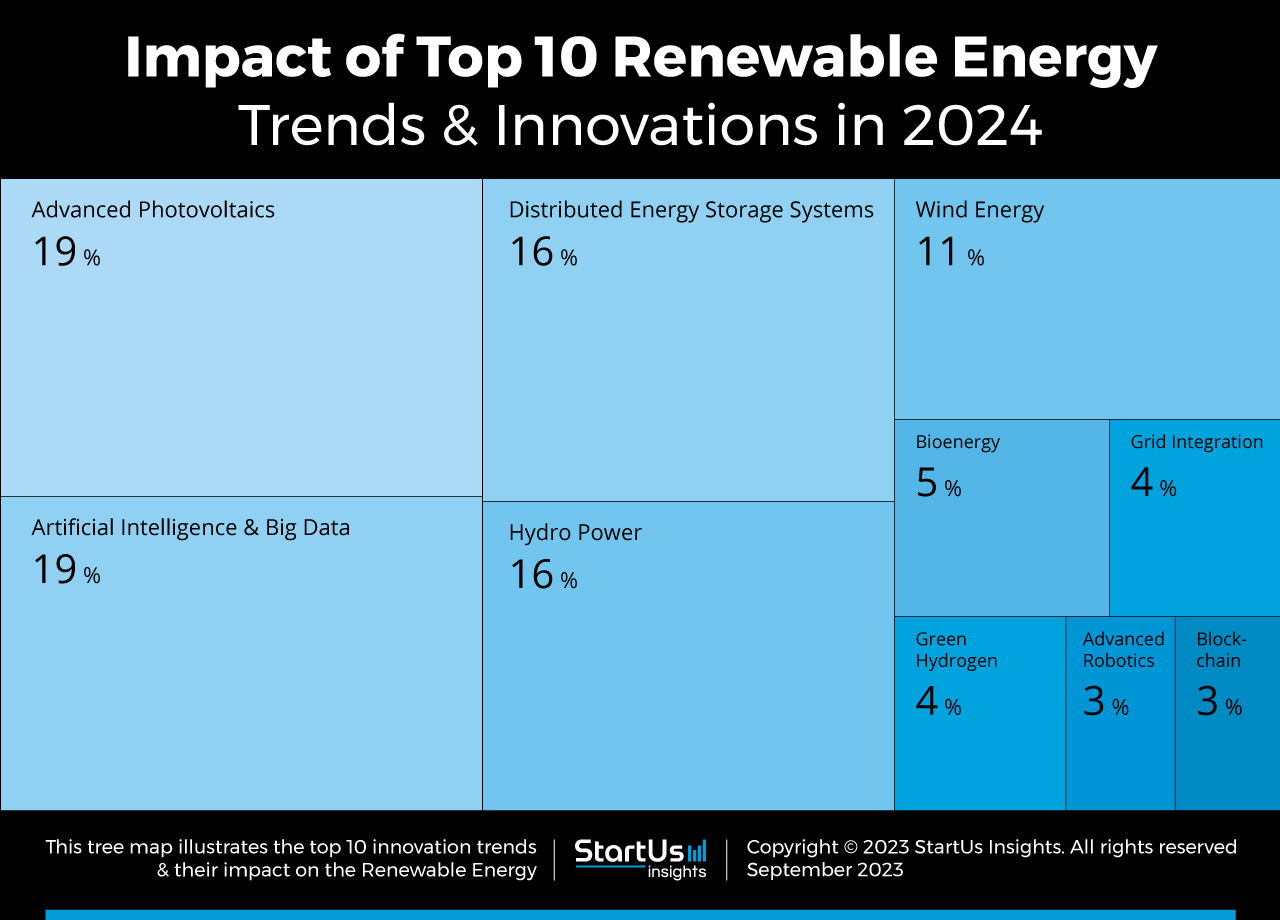

Global Startup Heat Map covers 5152 Renewable Energy Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 5152 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that Western Europe is home to most of these companies while we also observe increased activity in the US and India.

Below, you get to meet 20 out of these 5152 promising startups & scaleups as well as the solutions they develop. These 20 startups were hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

1. Advanced Photovoltaics

Solar companies are integrating PV systems with every aspect of our surroundings while minimizing the need for additional land usage. As a result, integrated PV, floatovoltaics, and agrivoltaics are logical shifts in trends. Additionally, startups are developing thin-film cells to make solar panels flexible, cost-effective, lightweight, and environment-friendly.

To improve PV performance, emerging companies are devising technologies to concentrate solar power using mirrors and lenses. Innovations in PV materials, such as the use of perovskite, are increasing energy conversion multifold. These innovations are further coupled with photovoltaic designs that enable maximum efficiency and high productivity.

Together, they promote sustainability through recycling, minimum resource utilization, and the use of alternate materials.

Lusoco provides Luminescent Solar Concentrators

Dutch startup Lusoco develops a luminescent solar concentrator technology. It uses high refractive index materials like glasses and polymers along with fluorescent ink to concentrate light to the edges where thin-film solar cells are placed. Moreover, the fluorescent coating also emits light during the night, enabling self-sustainable signages. The solution harvests energy while maintaining the aesthetics. The luminescent glasses are hence suitable for use in automotive, signages, and interior designing.

Norwegian Crystals makes Low-Carbon Monocrystalline Silicon Ingots

Norwegian Crystals is a Norwegian startup that manufactures low-carbon monocrystalline silicon ingots for high-performance photovoltaic devices. To produce these ingots, the startup melts high-purity silicon at high temperatures using the Czochralski technique. It also produces gallium-doped ingots that increase the lifetime of the solar cells and reduce the number of stabilization steps as compared to monocrystalline silicon. Through this, Norwegian Crystals control the carbon footprint of solar panel components at ultra-low levels, empowering consumers and businesses who consider the overall sustainability of solar energy generation.

2. AI and Big Data

The energy grid is one of the most complex infrastructures and requires quick decision-making in real-time, which big data and AI algorithms enable for utilities. Beyond grid analytics and management, AI’s applications in the renewables sector include power consumption forecasting and predictive maintenance of renewable energy sources.

It further enables IoE applications that predict grid capacity levels and carry out time-based autonomous trading and pricing. With innovations in cloud computing, virtual power plants (VPP) supplement the power generation from utilities. In addition, startups utilize data analytics and machine learning for renewable energy model designing and performance analysis.

Likewatt enables Energy Parameter Analysis

German startup Likewatt develops Optiwize, a patented software solution that provides energy parameter analysis using machine learning. Optiwize also calculates historical power consumption and carbon dioxide emissions as well as features renewable energy audits and weather forecasting. This allows individual and collective consumers to observe real-time consumption patterns. Moreover, it enables power producers to hybridize different technologies and optimize load sizing.

Resonanz facilitates Intelligent Energy Trading

Resonanz is a German startup that enables automated intelligent energy trading. The startup’s software tools, rFlow and rMind, integrate and manage data in real-time to create autonomous algorithmic decisions. Furthermore, the rDash interface visualizes production forecasts, market price indicators, and accounting data that aid decisions. Through these products, the startup enables market participants to increase their share of sustainable energy and returns at the same time.

3. Distributed Energy Storage Systems

DESS localizes renewable energy generation and storage, overcoming irregularity in production. Based on economic and other requirements, startups offer a range of battery and batteryless solutions. For instance, flow batteries leverage low and consistent energy, whereas solid-state batteries are lightweight and provide high energy density. For applications that require large amounts of energy, in a short period of time, capacitors and supercapacitors are also used.

Due to concerns regarding discharging, safety, and environmental pollution, startups are devising batteryless storage alternatives such as pumped hydro and compressed air technologies. On the other hand, surplus energy is converted to other forms of energy such as heat or methane for storage and reconversion through Power-to-X (P2X) technology.

Green-Y Energy offers Mechanical Energy Storage

Swiss startup Green-Y Energy develops compressed air energy storage technology. By increasing energy density while doubling the heat and cold extraction, the startup reduces the required storage volume as well as provides heat energy and cooling for domestic use. The process is also sustainable since water and air are the only working fluids. In addition, this compressed air is stored in durable and inexpensive commercial pressure tanks, allowing building managers and homeowners to integrate renewable energy systems.

MGA Thermal produces Thermal Energy Storage Material

MGA Thermal is an Australian startup that enables thermal energy storage. The startup’s product, Miscibility Gap Alloys, has a melting phase and a solid phase contact. On heat application, the melting phase component stores energy while the solid phase component rapidly distributes the heat. The resulting modular block structure exhibits high energy storage capacity at a constant temperature.

Moreover, the materials and containment units used are recyclable, safe, affordable, and easy to use. The large-scale storage potential of this solution enables renewable energy utility companies to provide continuous electricity even during peak hours.

4. Hydropower

Hydropower is the energy derived from moving water. Unlike solar and wind, hydro energy is predictable and, hence, more reliable. Besides, hydroelectric dams, as well as ocean-based energy harnessed from tides, currents, and waves, offer high energy density while reducing dependency on conventional sources.

The innovations in these renewable sources focus on energy converters and component improvements for harvesting energy more efficiently. Within hydropower, small-scale hydroelectric dams and tidal barrages enable decentralized energy generation. Ocean thermal energy conversion (OETC) harnesses energy through the thermal gradient created between the surface and deep water.

Some startups are also converting the salinity gradient formed due to the osmotic pressure difference between seawater and river into usable energy.

Seabased provides Modular Wave Energy Converter (WECs)

Seabased is an Irish startup that develops modular wave energy converters. These WECs are buoys on the surface connected with linear generators resting on the seabed. The moving waves provide energy to the buoys thereby generating electric power. The startup’s patented switchgear converts the power into electricity for grid use.

Moreover, the WECs can withstand harsh seas, enabling a flexible wave park expansion with high efficiency. Seabased’s solutions, thus, allow energy offshore companies and local coastal communities to generate wave energy as an alternative or hybrid to wind.

Green Energy Development (GED) Company designs Microturbines

Iranian startup GED Company offers microturbines for distributed generation of hydroelectricity from water streams like canals and rivers. The startup’s floating drum turbine (FDT) consists of an undershot waterwheel that floats on the water stream using a buoyant skid and is anchored with cables or hinged arms. The rotation of FDT by the stream produces electricity. The solution is low-cost, efficient, and ensures reliable distributed generation for electrification in remote and underdeveloped locations.

5. Wind Energy

Despite being one of the oldest energy resources, the rapidly evolving nature of the wind energy sector makes it one of the major trends. Startups are devising offshore and airborne wind turbines to reduce the demand for land-based wind energy. Innovations in this field often integrate with other energy sources such as floating wind turbines, solar, or tidal energy.

To further improve efficiency, there are constant advances in the aerodynamic designs of the blades. Startups also develop efficient generators and turbines for high-energy conversion. The sustainability of blade material is one of the challenges the industry faces today. To tackle this, startups are creating bladeless technologies and recyclable thermoplastic materials to manufacture blades.

Hydro Wind Energy offers Hybrid Hydro-Wind System

Based out of UAE, UK, and the US, Hydro Wind Energy provides a hybrid energy system. The startup’s product, OceanHydro, harnesses offshore altitude wind using kites or vertical axis wind rotors. It then combines wind energy production power from subsea oceanic pressure to obtain low-cost electrical energy and grid-scale storage.

Since the energy from the subsea is available on demand, such a hybrid solution is more reliable than offshore wind energy systems. This allows energy companies to maintain a continuous and higher base load for the grid.

Helicoid enhances Wind Blade Quality

Helicoid is a US-based startup that provides enhanced blade quality during wind blade manufacturing. The enhanced blade is produced as a result of changes in stacking and rotation of sheets of parallel fibers to form a helicoid structure. These blades have higher resistance to impact, erosion, and fatigue while also possessing higher strength and stiffness. This reduces maintenance and downtime costs as well as offers sustainable and energy-efficient blades for large-scale windmills.

6. Bioenergy

Bioenergy constitutes a type of renewable energy derived from biomass sources. Liquid biofuels with quality comparable to gasoline are directly blended for use in vehicles. To achieve this quality, companies improve biofuel processes and upgrade techniques. The majority of biofuel conversion processes like hydrothermal liquefaction (HTL), pyrolysis, plasma technology, pulverization, and gasification use thermal conversion for obtaining biofuels.

Further, upgrade techniques like cryogenic, hydrate, in-situ, and membrane separation are used for removing sulfur and nitrogen content. Similarly, the fermentation process produces bioethanol which is easy to blend directly with gasoline. Fermentation also has the ability to convert waste, food grains, and plants into bio-ethanol, thereby providing feedstock variability.

Energy-dense feedstocks result in optimum fuel quality. For this reason, startups and big companies consider algal and microalgal feedstocks for use in the aforementioned conversion processes.

Phycobloom produces Algal Bio-Oil

Phycobloom is a British startup that uses synthetic biology to produce bio-oil from algae. The startup’s genetically engineered algae release this oil into the surroundings. Since the same batch of algae is reused, it makes the process fast and inexpensive. Considering that algae require only air, water, and sunlight to grow, this technology also closes the loop between greenhouse gas emissions and fuel production. The startup’s solution thus lowers the dependency of the transportation sector on fossil fuels.

Bioenzematic Fuel Cells (BeFC) provides Paper-based Biofuel Cell

French startup BeFC generates electricity using a paper-based biofuel cell system. The system combines carbon electrodes, enzymes, and microfluidics. The enzymes convert glucose and oxygen into electricity using a miniature paper material. The technology is suitable for low-power applications, like sensor data collection and transmission. Moreover, the absence of plastic and metal makes it a sustainable and non-toxic form of energy storage means.

7. Grid Integration

Grid integration technologies primarily include transmission, distribution, and stabilization of renewable energy. Scaling up variable renewable energy generation is often far from demand centers which results in transmission and distribution losses. To overcome this, energy-efficient, grid electronic technologies such as Gallium Nitride (GaN) and Silicon Carbide (SiC) semiconductors are leveraged.

The challenge of frequency and voltage fluctuation due to variable renewable energy generation is solved through microcontroller-based solutions. Despite these technologies, stabilization of the grid is a huge challenge due to intermittent energy usage. Vehicle-to-grid (V2G) technology empowers the stabilization of the grid during peak hours while grid-to-vehicle (G2V) solutions leverage the vehicle as a storage unit. As a result, both the energy and transportation industry benefits.

Ageto Energy designs Microgrid Controllers

Ageto Energy is a US-based startup that produces microgrid controllers for coordinating all the elements of the microgrid. The startup’s microgrid controller, ARC, functions as a brain for the microgrid and integrates various conventional and renewable resources, including energy inverters, generators, power meters, and sheddable loads. ARC is encased in a durable enclosure to withstand extreme weather and temperature. In addition, it provides real-time monitoring and control of the microgrid.

Veir develops High-Temperature Superconductors (HTS)

US-based startup Veir offers high-temperature superconductors. The startup’s HTS cable operates at up to ten times the current of conventional wire while maintaining superconductivity. To maintain the HTS at operating temperature, Veir uses evaporative cryogenic cooling, which is twenty times more efficient than mechanical subcooling. This enables the generation and transmission of large-scale renewable energy, empowering utilities to easily transition to cleaner fuels.

8. Green Hydrogen

Hydrogen gas has the highest energy density of all fuels and produces near-zero greenhouse gas emissions (GHG). However, most hydrogen is derived from non-renewable sources in the form of grey and brown hydrogen. In the past decade, developments in renewable energy and fuel cells have pushed the shift to green hydrogen. While cleaner, it also struggles with the problems of low energy conversion efficiency of fuel cells and challenges in transportation. For these reasons, the developments in green hydrogen focus on improving hydrogen storage, transport, and distribution.

Lavo offers Green Hydrogen-Lithium Hybrid

Australian startup Lavo manufactures green hydrogen fuel cells that use solar energy and water to produce electricity. The startup’s patented solution, Lavo Hydrogen Battery System, features a metal hydride storage vessel that stores hydrogen. It also contains a lithium-ion battery for fast response time, thereby making it a hybrid solution. The battery system is durable and operates under wide temperature ranges. As a result, it avoids power outages under extreme weather conditions as well as enables businesses and communities to continuously store energy for days.

ElektrikGreen enables Green Hydrogen-based Fuel Cell Vehicles (FCVs)

ElektrikGreen is a US-based startup that uses green hydrogen to charge fuel cell vehicles. The startup’s at-home refueling station enables the charging of FCV by adding a fuel filler to the green hydrogen storage tanks. The technology integrates power conversion, energy storage, predictive management software, monitoring, and refueling, all in one simple-to-install system. ElektrikGreen’s solution also supports smart neighborhoods to maximize shared benefits through distributed energy.

9. Advanced Robotics

Production and process efficiency prove to be a major hurdle in harnessing renewable energy. Robotics enables accuracy and optimum utilization of resources to overcome this challenge. For example, automated solar panels orient themselves to maximize energy conversion. Equipment automation also expedites the maintenance processes while reducing the need for human work.

Drone inspection and robotics-based automatic operations and maintenance (O&M) handle dangerous repetitive work, thereby improving safety and productivity. An example of this is the use of drones based on phased array ultrasonic imaging to hastily detect internal or external damages on large wind turbines. Drones further enable the creation of digital twins and 3D maps using various data.

Greenleap Robotics designs Solar Panel Cleaning Robots

Indian startup Greenleap Robotics develops an autonomous cleaning robot for solar panels. The startup’s robot, Lotus A4000, uses ultra-soft microfiber cloth for removing dust and debris, enabling water-less cleaning. It also traverses misalignments among solar panels resulting in an improved cleaning range. Besides, centralized control facilitates predictive maintenance and self-charging for the robot. Greenleap Robotics enables large-scale solar plants to automate their labor-intensive work while being able to control and monitor it remotely.

SupAirVision provides Drone-based Blade Diagnostics

SupAirVision is a French startup that provides digitized wind blade diagnostics. The startup’s software tools, Sherlock and Volta, use AI to detect defects on the blades and diagnose the lightning paths of the blades, respectively. Another software tool, Clarity, detects the structural defects inside the blade. Together, they provide accurate, safe, and precise diagnostics, thus reducing wind turbine downtime. The technology benefits utility-scale wind turbine farms by offering scalable management solutions with minimum staff requirements.

10. Blockchain

Energy startups utilize blockchain technology to advance trusted transactions in the renewable energy sector. For instance, smart contracts advance peer-to-peer (P2P) electricity trading for transactive energy. Grids are vulnerable to cyber threats and blockchain is used to encrypt the data associated with grid operations and monitoring.

Through data encryption, blockchain facilitates digital transactions. Renewable energy providers are also taking advantage of blockchain to track the chain of custody of grid materials. Additionally, it allows regulators to easily access data for regulatory compliance.

Sitigrid offers P2P Energy Trading

British startup Sitigrid offers P2P energy trading using S-Chain, its patented distributed ledger technology. Using smart contracts, the startup facilitates the trading of surplus electricity in the open market and keeps a record of the transaction. It uses AI to optimize trades, thereby maximizing revenue for generators and minimizing costs for consumers. The underlying architecture provides local markets with an efficient settlement platform and empowers energy players to aggregate network services.

Green Life Energy promotes Renewables using Blockchain Tokens

UK-based startup Green Life Energy promotes the renewable energy sector through blockchain technology. It bridges the gap between Web3 utility and traditional industries through its digital carbon marketplace and ReFi (Regenerative Finance) payment platform. The platform reduces fraud, increases safety, and validates the nature of transactions.

By applying this model to renewable energy traders, carbon offsets, and renewable models, the startup helps the industry achieve systemic efficiency increases. Moreover, stakeholders enjoy all the benefits of transparency and accountability that blockchain offers.

Discover all Renewable Energy Technologies & Startups

To tackle climate change and meet environmental compliance, companies are turning to clean and sustainable energy. The challenge lies in making renewable energy cost-competitive with fossil fuels. Hardware innovations like advanced photovoltaics such as nanofibers and mono-passive emitter real contact (PERC) based panels improve solar conversion efficiency. Moreover, research on platinum-free catalysts, such as tin carbon, is enabling cheaper green hydrogen fuel cells.

The renewable energy trends and startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & technologies to implement into your business goes a long way in gaining a competitive advantage.

Start US Insights

Despite a record renewable growth in 2023, the energy transition remains off track due to persistent structural barriers and a notable shortfall in investment.

Despite a record renewable growth in 2023, the energy transition remains off track due to persistent structural barriers and a notable shortfall in investment.

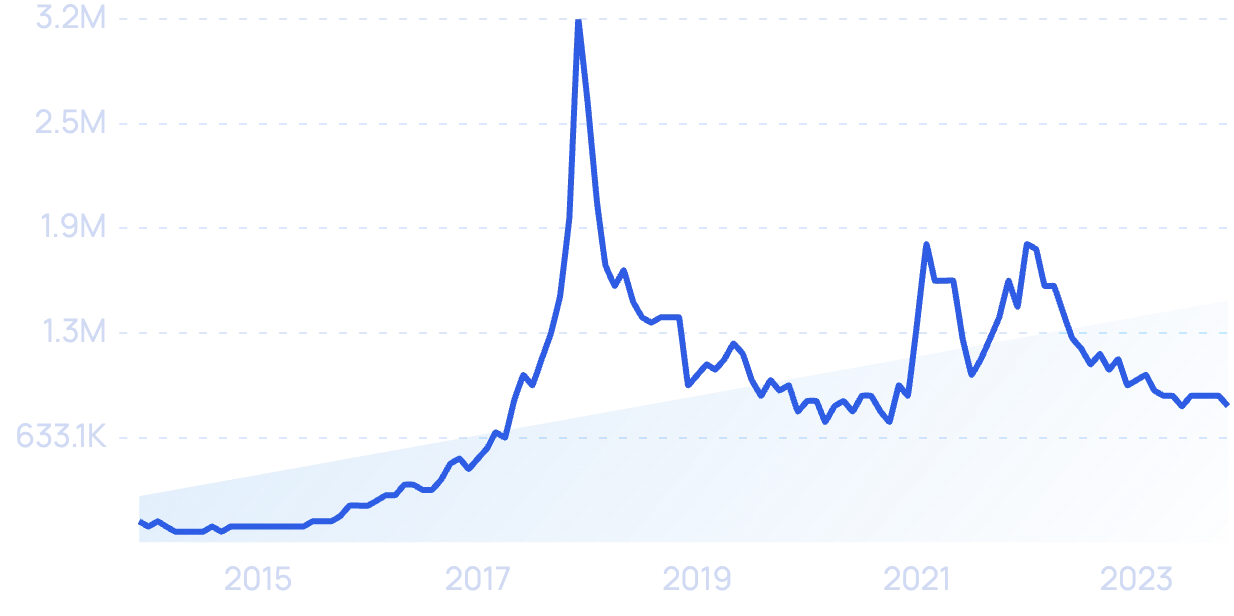

Search interest in “blockchain” has risen by 550% in 10 years.

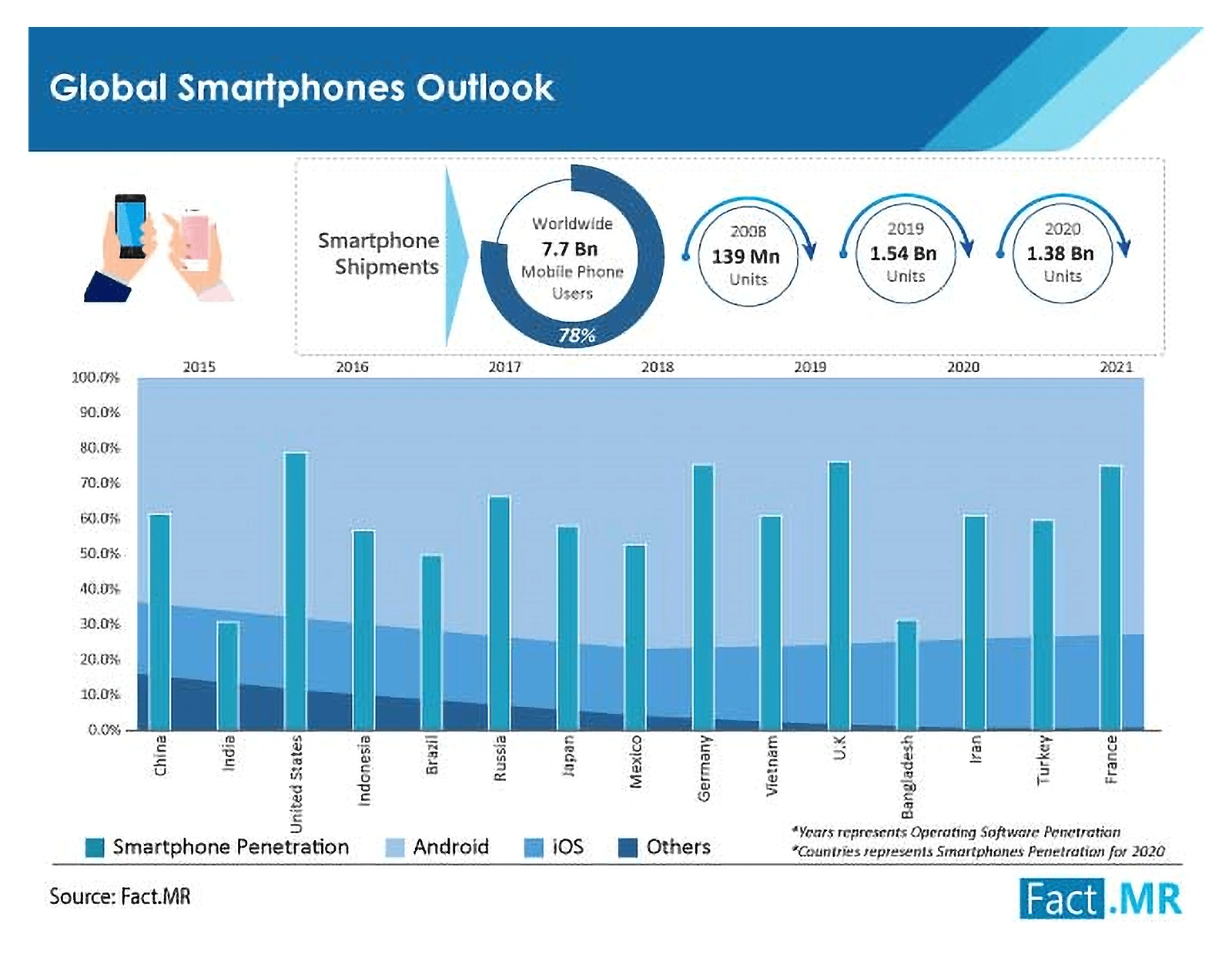

Search interest in “blockchain” has risen by 550% in 10 years. 7.7 billion people have smartphones and

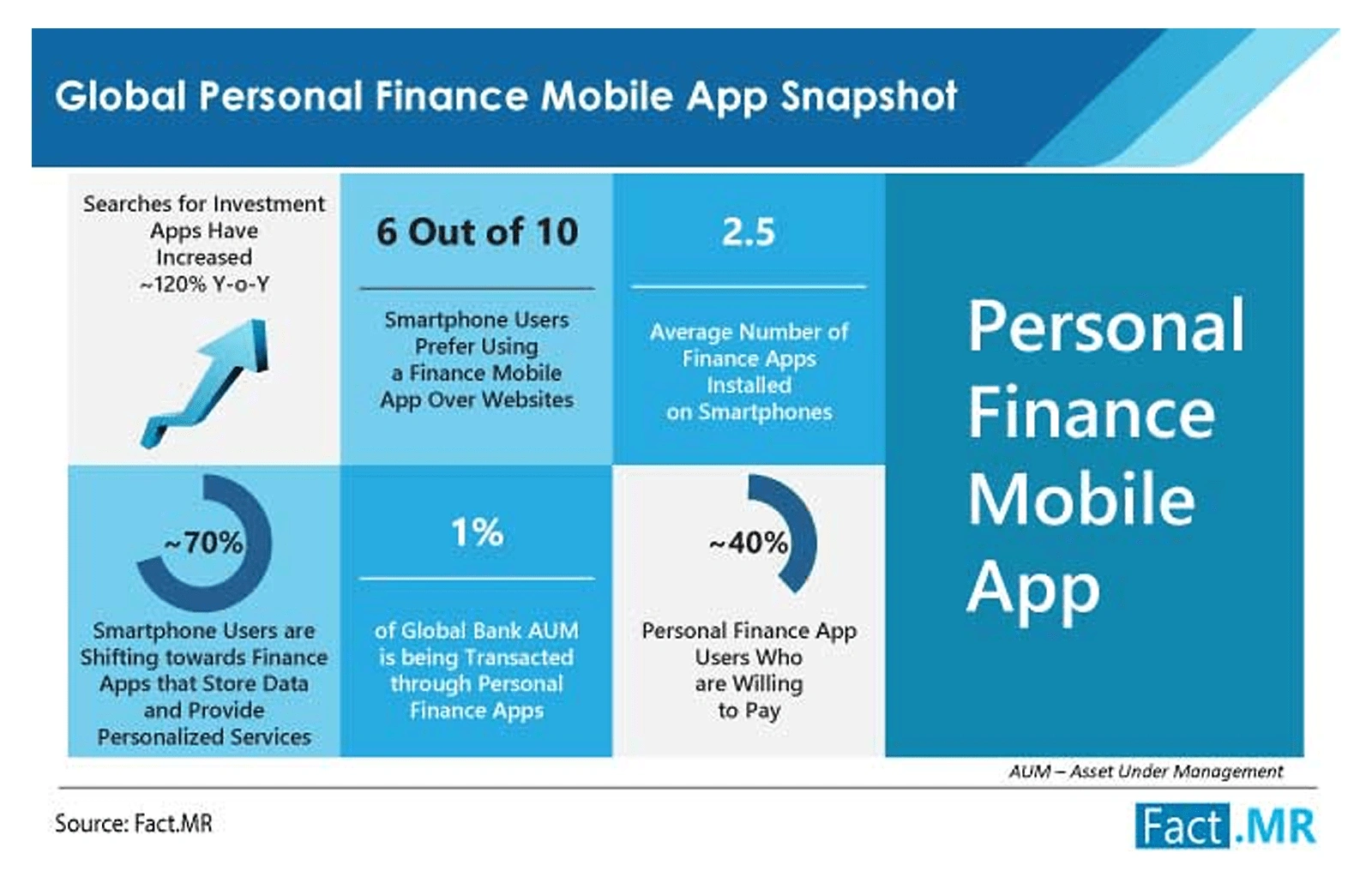

7.7 billion people have smartphones and  6 out of 10 users

6 out of 10 users  Searches for “Cash App” have risen 94% over the last 5 years.

Searches for “Cash App” have risen 94% over the last 5 years. Total

Total  The

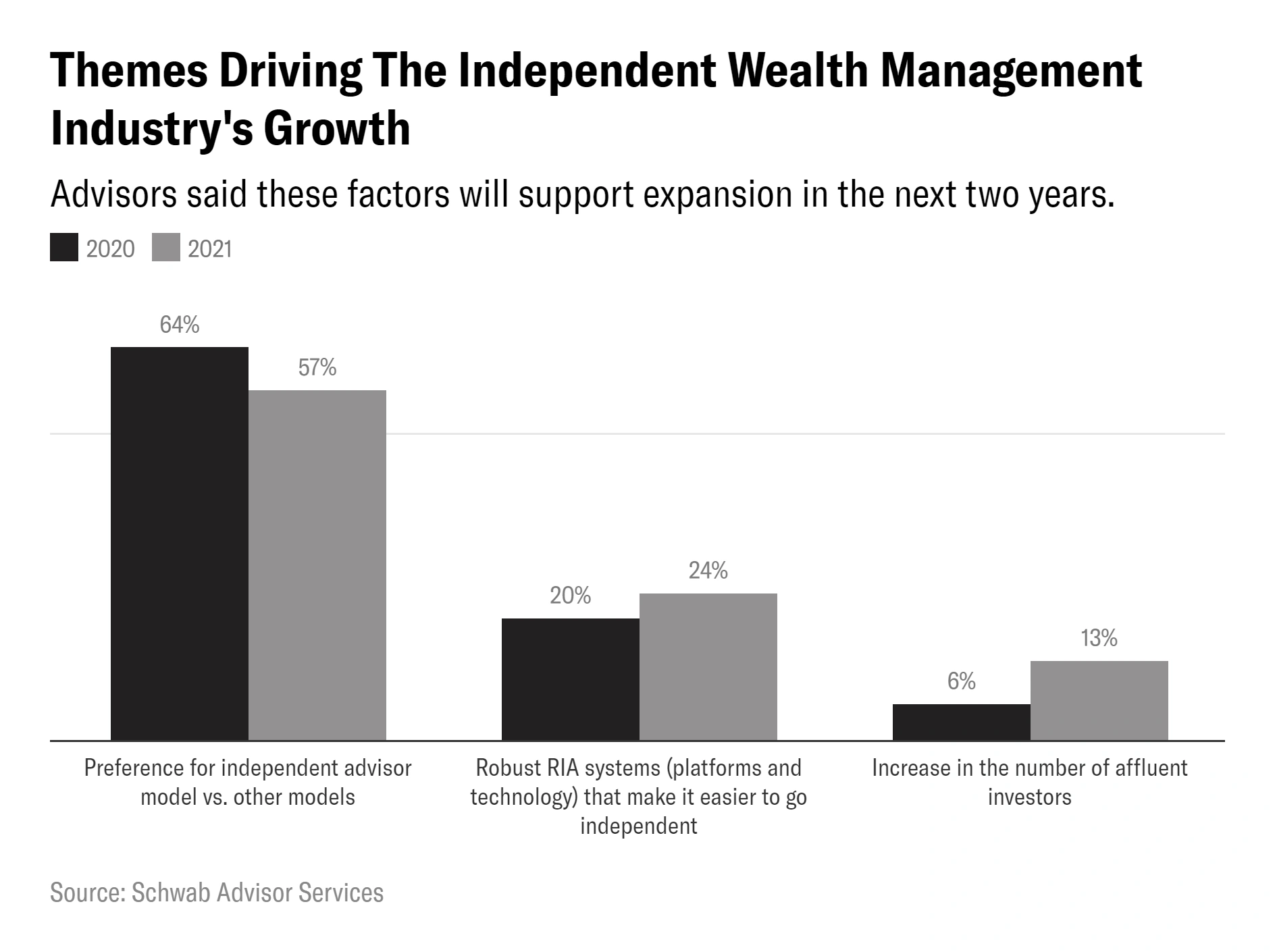

The  The trends that are

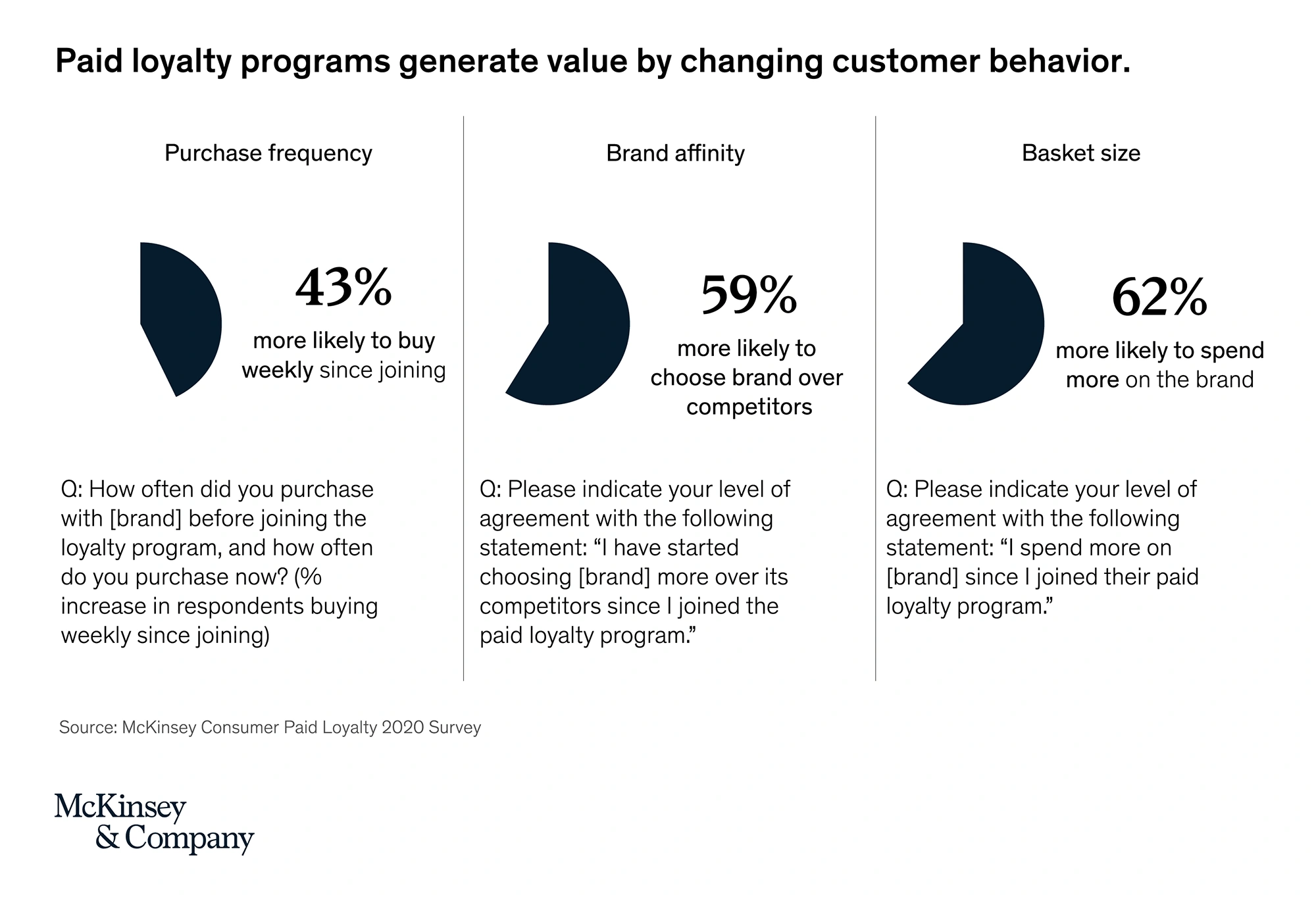

The trends that are  Customers

Customers  Search interest in “MANTL” over the last 10 years.

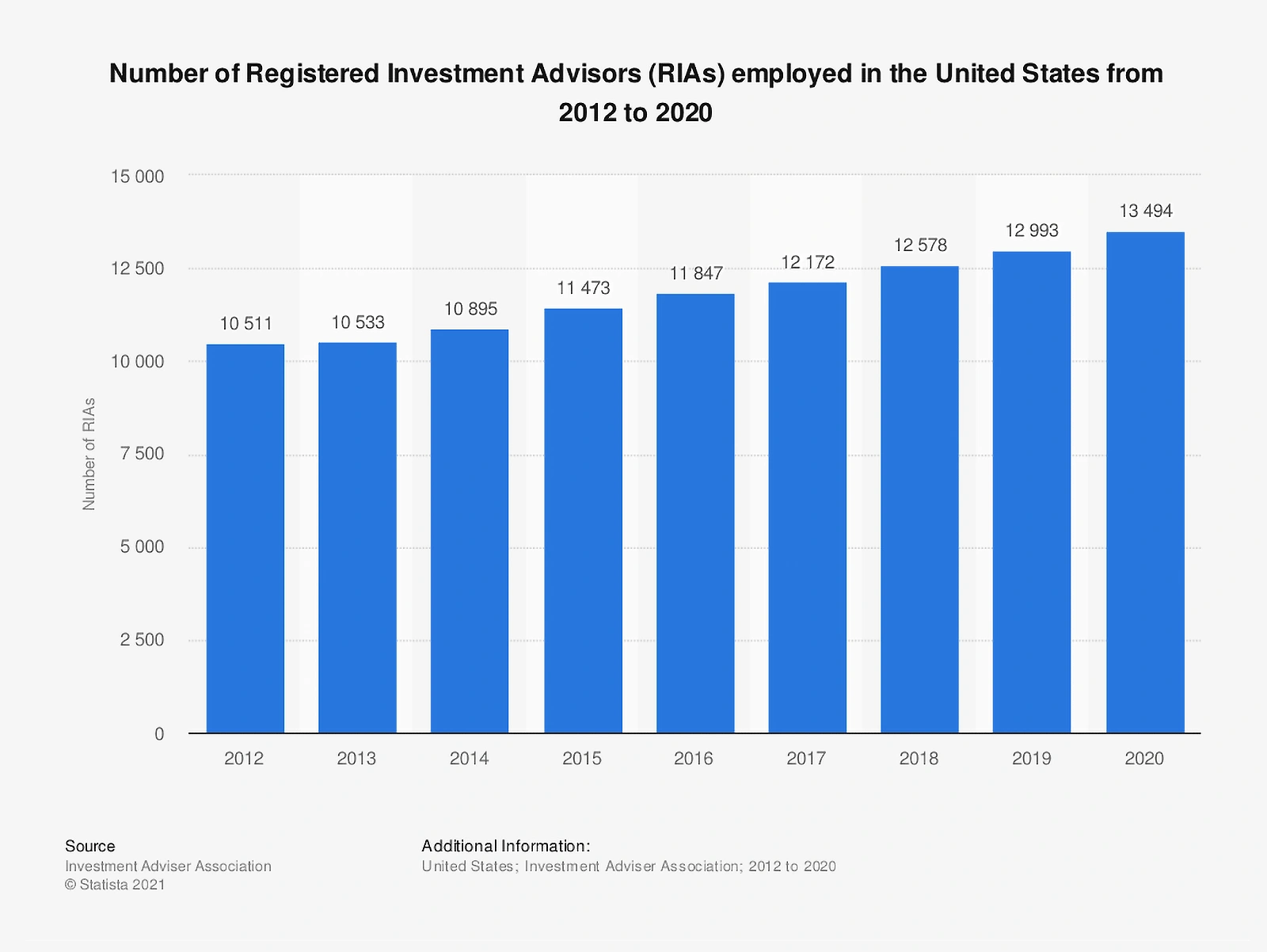

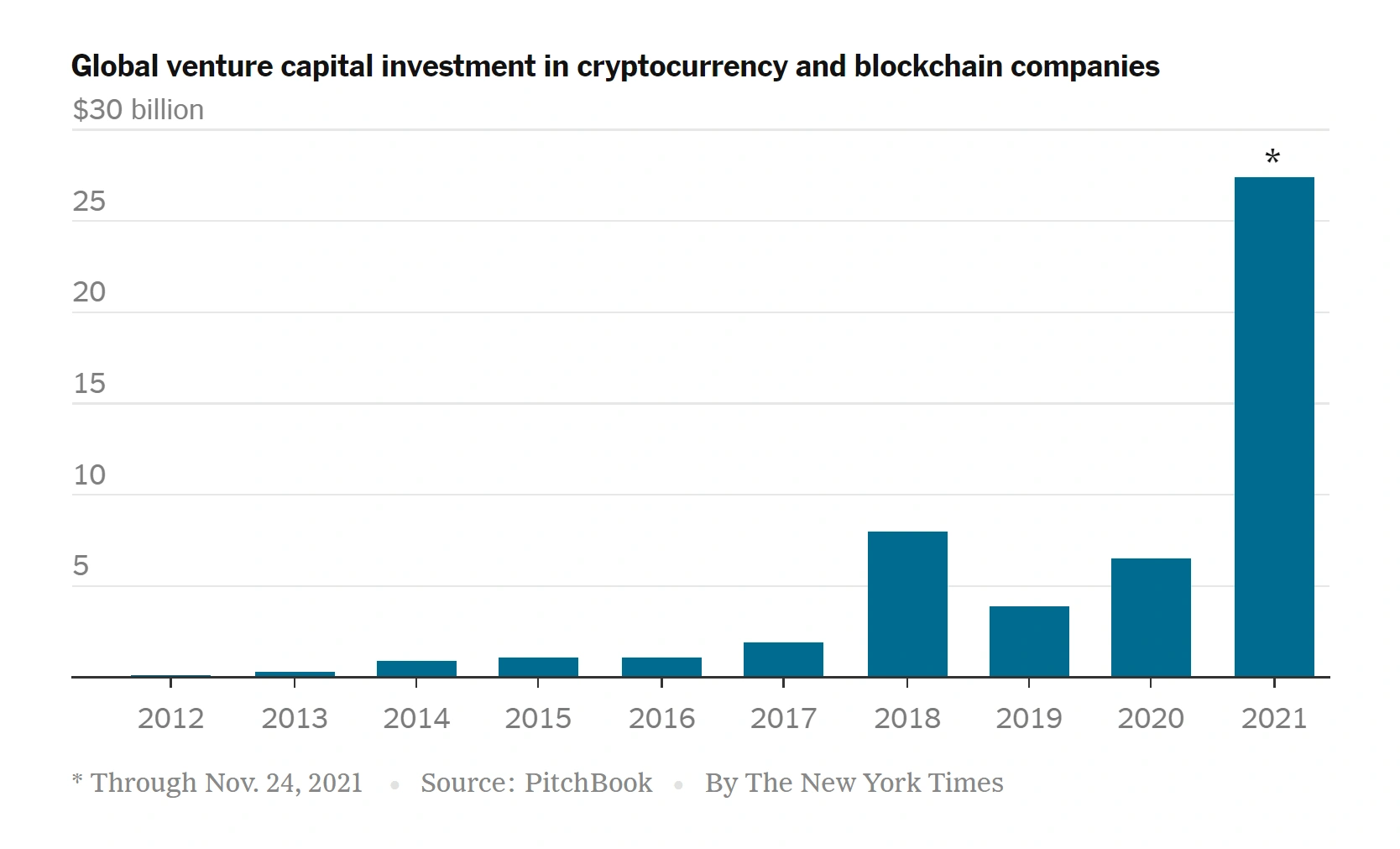

Search interest in “MANTL” over the last 10 years. Venture capital firms

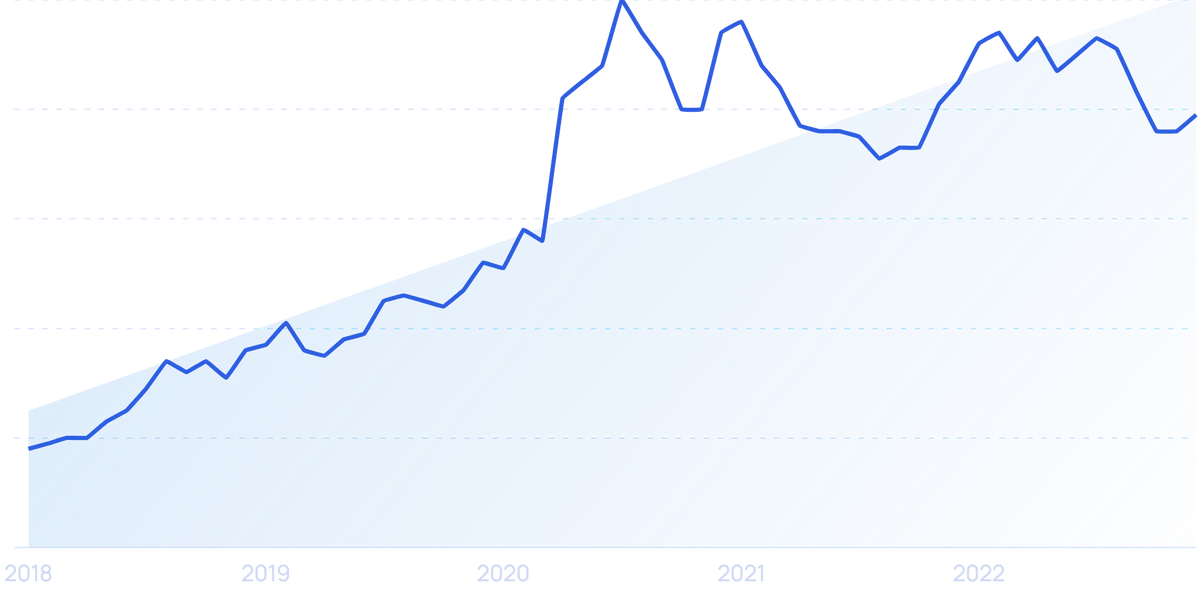

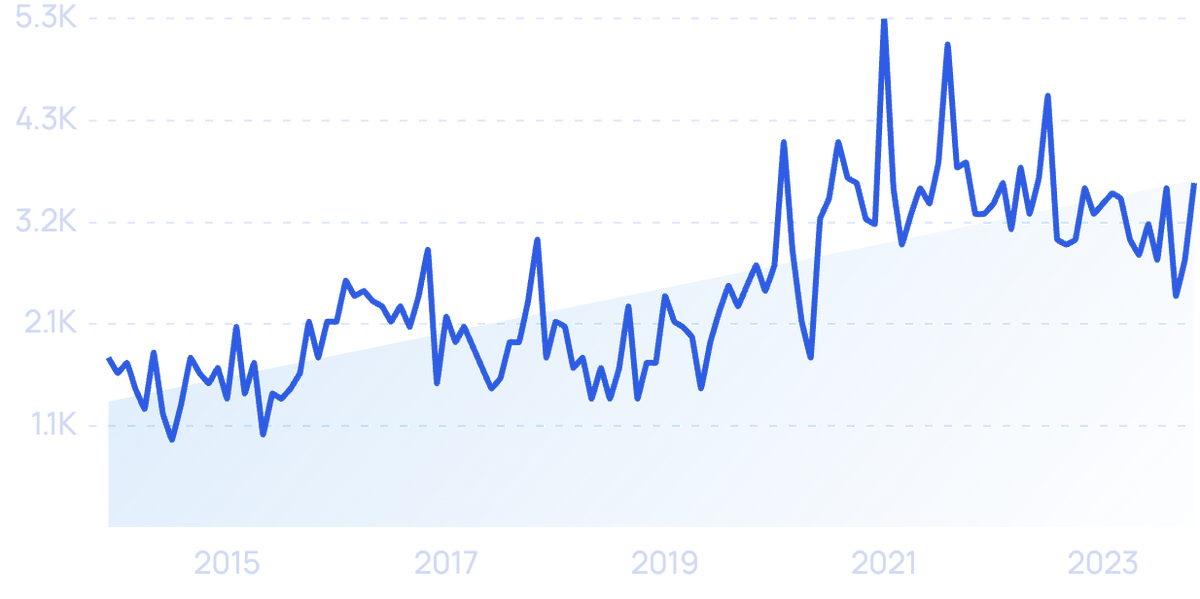

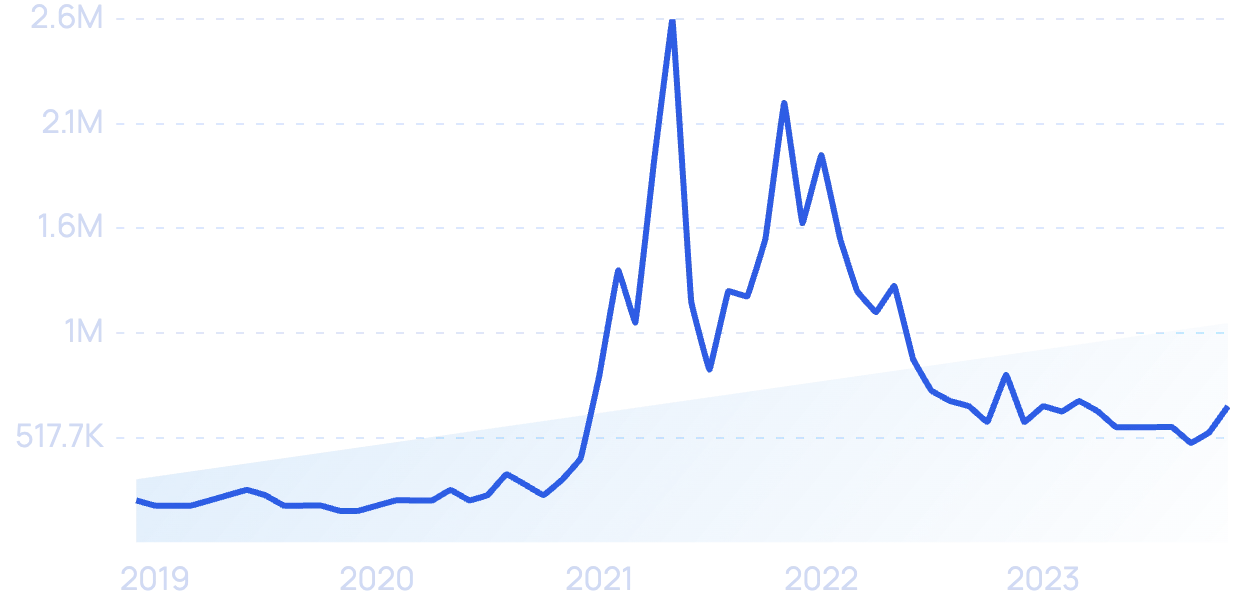

Venture capital firms  Search interest in “cryptocurrency” over the last 5 years.

Search interest in “cryptocurrency” over the last 5 years.